Jun 10, 2024

INVESTMENT

MARKET

The Risk of Flipping

Key Points

Buying a House: A Safe and Profitable Investment

Home Flipping

Risks of Flipping

Real Estate in California

Buying a House: A Safe and Profitable Investment

Buying a house, whether to live in or to earn a return through sale or rental, is one of the most profitable and safest investments, with very low risk compared to other types of investments. If you want to learn more about investment opportunities in the real estate world, here are some booming opportunities that can generate significant profits and capital growth.

Home Flipping

One of the standout business opportunities, due to its increase and as an alternative to the low supply or low inventory of homes and the high cost of new houses, is flipping. This involves buying old or deteriorated houses to remodel them and then sell or live in them.

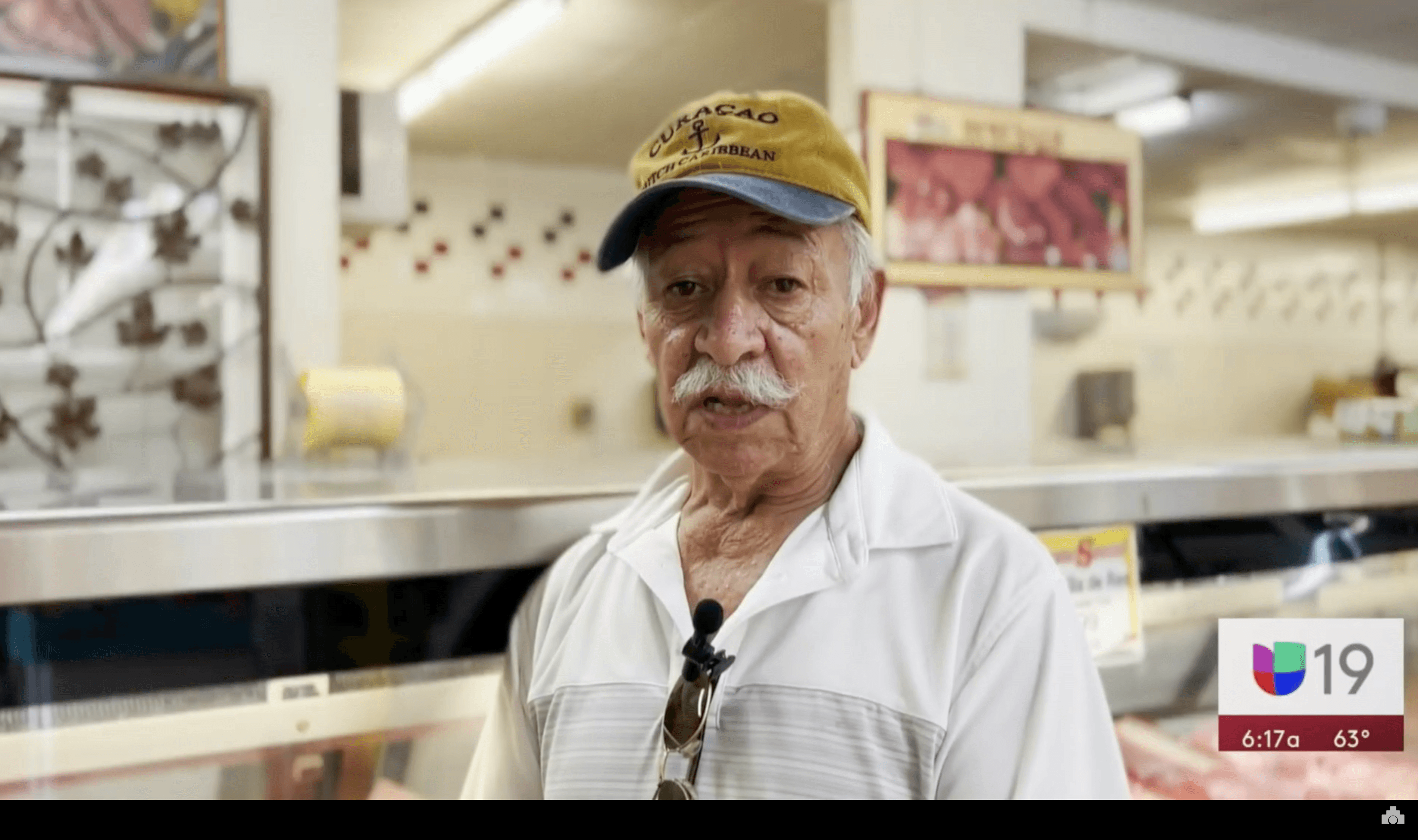

According to Luis Ramírez, an expert in the U.S. real estate market, in the current market, the price per square meter of a new property can cost double that of an old house. Thus, flipping has become a good option for investors who cannot afford to invest in new properties.

In fact, in the first quarter of this year, flipping accounted for 9.6% of all homes sold, the highest rate since 2000, compared to 6.9% in the last quarter of 2021. However, the gross national return on investment for flipping was 25.8% in the first quarter of 2022, compared to 27.3% in the previous quarter, according to a report by ATTOM showing increases in flipping. Additionally, it reflects that the median price of remodeled homes in the first quarter of 2022 increased to another historic high, 10.5% more than in the fourth quarter of 2021.

Ramírez recommends that if the profit from flipping (for which you must add the investment in purchasing the old property and the budget for the renovation) gives you the minimum market profit of 10%, you can do it twice a year, yielding a 20% return.

Risks of Flipping

The risk lies in taking too long with the remodeling and permits. It's crucial to analyze the timelines in the county or city where the flipping is being done. Another risk can be a tax increase in the city. If this happens, you may incur losses because if the property sale takes more than six months, you will have to pay higher annual taxes. Also, many buyers looking for low-tax areas might avoid such locations.

This has happened, for example, in Austin, Texas, where homebuyers are backing out, with tax increases being one of the factors cooling the market. Crystal López, a Redfin agent, mentioned that in a recent case, she helped a client negotiate the sale of an investment property for around $550,000, but a new tax assessment doubled the levy on the house, causing the buyer to withdraw.

Real Estate in California

In an interview conducted by Luis Ramírez with Gina González, a real estate specialist in California, regarding the types of properties sought by investors and people wanting to live in California, she highlighted that besides flipping, many builders already have new houses constructed due to the need for new homes.

Especially in Sacramento, another highly sought opportunity for an average family needing to buy a home is the “single-family house” with three bedrooms and two bathrooms. For higher profitability, the segment with the most opportunity is multifamily properties.

Now that rents provide a return of 15 to 20% more than buying a single house, investors or people with money are buying and renting one or more units in multifamily properties—duplexes, triplexes, or quadruplexes—and sometimes live in one unit. Renting these units allows them to receive rental income (cash flow) and appreciate the value of these multifamily units over the years, according to Gina.

For more information, advice, or participation in these opportunities, contact us. We are Perfecto Homes, and our knowledge and experience are here to serve and support you in your real estate investments.

Keep on Reading…

All Blogs